TobinLeff partner and former Ernst & Young CPA, Chuck Gottschalk, is back. In this White Paper on synergies in M&A, he explains how you can think strategically and proactively about synergies from combining firms, and how that information can help you realize a better value when you sell your own company.

Click on the link below to learn about:

- The difference between hard and soft synergies in M&A

- Ways to estimate the synergies that you can bring to a buyer (or can gain as a buyer)

- How to use this information to optimize a deal

As always, feel free to contact Chuck, or any of the TobinLeff partners, with questions.

Click here for your complimentary copy: TL Synergies White Paper

Understanding Synergies in M&A and How They Might Increase the Selling Price of Your Business

In mergers and acquisitions (M&A), there are nearly always synergies to be found.

A “synergy” is a mutually beneficial concurrence or compatibility of distinct business participants or elements such as resources or services. In other words, it’s the elimination of duplication of efforts and/or the creation of more efficient spending/purchasing power – all designed to enhance the bottom line.

In applying this to any M&A transaction, synergy is the idea that the value and performance of two combined companies will be greater than the sum of the separate individual parts. In other words, one plus one equals three (or four or seven).

The key point here is that, when you are preparing to sell your company, understanding the nature and types of synergies in M&A can increase the price a buyer will pay.

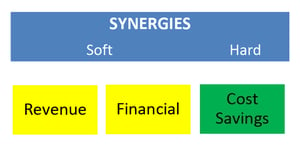

Classes of Synergies in M&A

It is common to categorize synergies into two classes: soft and hard. Soft synergies refer to revenue and financial benefits. There is as much art as there is science in predicting the impact of an acquisition on synergies of this type. Hard synergies refer to cost savings and can be objectively measured up front.

Soft Synergies

Revenue synergy is based on the concept that two companies combined can generate higher sales than they could individually. This is often due to an increased offering of services. Research indicates that it often takes several years to achieve these revenue synergies. This is due to the amount of time it takes sales strategies across all functions to fully take hold. Additionally, in the early years of an acquisition, increased revenue as a result of the increased offerings may be mitigated by the loss of a client(s). As a seller, it is generally best to let the buyer decide what type of revenue synergies will be achieved without trying to objectively quantify them; objectively applying numbers could result in the buyer demanding performance goals for earn-out payments that you may not want to accept.

Financial synergy in the MarComm space is most often limited to improvement in the cost of capital. A bank will most often view a larger company as a lower credit risk and, therefore, offer a lower interest rate or be willing to loan a larger amount to the combined companies than to the two standalone entities. It is difficult for a seller to estimate the amount of these potential financial synergies. Much like with revenue synergies in M&A, leave this to the buyer to decide what type of value might be achieved.

Cost (Hard) Synergies

The rest of this discussion will focus on cost synergies (savings). These can generally be identified in advance of a sale and, thereby, allow you to market your company from a position of strength, using objective data since many cost synergies in M&A are based on solid facts set out in the profit and loss statement rather than towering assumptions and best-case scenario suppositions. Cost synergies also can be more easily managed/controlled than revenue synergies. Finally, cost synergies are more suitable for achieving in the short term and, therefore, more likely to push the price a buyer is willing to pay.

Cost synergies generally come from economies of scale or the elimination of duplicated services. The basic principle of economies of scale is: the bigger the company’s operations, the lower the costs per unit produced. Size does matter.

Bigger companies have better chances of improving their purchasing power and finding suppliers that can provide items and services at low costs. Although in the MarComm space we don’t think of what is being sold as a “unit,” in fact, every business at its core produces something that can be converted into a unit. For example, if instead of thinking of revenue per employee, we think of total cost per employee, then the employee becomes the unit from which economies of scale cost synergies can be realized. If we reduce the cost per employee, we increase the bottom line.

How does a marketing firm achieve these cost reductions? Primarily by reducing sales, general and administrative expenses through the consolidation of headquarters and support functions. For marketing firms, these savings are typically seen in marketing and advertising for the firm’s services, dues and subscriptions, and, most notably, administrative functions like finance and human resources. Office leases also can be a big source of synergistic savings; however, this has become a much more variable area as a result of the accelerated movement toward virtual workspaces.

Cost synergies can be assessed very precisely because they are based on objective data. You will want to simply eliminate these costs in your financial modeling from day one. However, before diving into specific cost synergies and ways to estimate them, it is important to note that cost synergies are not effective immediately after the merger takes place. Typically, these synergies are realized two or three years after the transaction. This period is known as the “phase in” period, where operational efficiencies, cost savings, and incremental new revenues are slowly absorbed into the newly merged firm. A seller should be prepared to acknowledge this in their discussions and modeling. In fact, in the short-term, costs may actually go up as one-time integration expenses and short-term inefficiencies due to lack of history of working together and initial culture clashes are resolved.

Examples of Ways to Estimate Cost Synergies in M&A:

- Evaluate any corporate office or rent savings that may be realized by combining offices. If the buyer has the physical space to absorb your entire staff, you can eliminate not only the rent, but the utilities, internet access fees, copiers and office cleaning.

- Estimate the value saved by sharing resources that aren’t at 100% utilization. For example, if you have a graphics printer that you use on occasion and the buyer has the same capability, that expense can be eliminated (subject to any ongoing lease agreements).

- Analyze headcount and identify any redundant staff members that can be reduced. Once you know the buyer’s structure, you will be in a position to complete this task, but these potential opportunities should be modeled to establish your estimated price range in advance of marketing your firm for sale. One thing to keep in mind is that savings may be less than a full 100% on the dollar. For example, in the case of the elimination of a CFO, the surviving CFO will often require a higher salary as they will have greater responsibility, so the savings might only be 75-85 cents on the dollar. Also, keep in mind that as a creative services firm, your main asset is your talent. It is very rare for buyers to plan significant reductions to your client or creative teams. Their talent and your customers are the main things they will be purchasing. For acquisitions in the marcomm space, synergies from staff reductions are usually focused on administrative redundancies.

- Look at ways to consolidate vendors and negotiate better terms with them. You will want to look to the services that you are buying and then imagine your company twice or four times as large. How would these services look then? Would web hosting fees be materially different? Would certain software services be the same – such as accounting/financial reporting packages?

- Reduce professional services fees. If you double the size of your firm, the tax preparation fees and independent financial statement preparation fees will not be doubled – at the very least they should be reduced by 50% of the current cost. Legal fees unfortunately don’t fall into these potential savings as they tend to grow more proportionately with revenue and headcount. However, insurance premiums also should go down.

- Consider shared information technology. Each company may have proprietary access to information technology that would allow for operational efficiencies if applied or used in the other firm. Alternatively, you might be paying for access to identical information, in which case a material savings can be realized.

Conclusion

So, what does all this mean to you when preparing your company for sale? The first step is having a detailed understanding of your own cost structure. Then complete the uncomfortable task of looking around your organization to identify where you are less efficient.

The next step is putting yourself in a buyer’s shoes. Try to gain an understanding of potential buyers’ operations regarding the items outlined above as soon as they express interest so that you can quickly identify the potential elimination of costs and build a spreadsheet that quantifies these items.

Finally, assemble the detailed support for these items and have this available to present to the buyer. Then, when the time comes for the offer, you may be able to use this information to suggest the buyer increase it based on objective data. Remember that the initial numbers you present may not contain all of the synergies, as you will not know them until you understand the similarities between your company and the buyer.

Some buyers may argue that synergistic savings should not be a consideration when setting purchase price because they are buying the business as is, not as improved. Even if this happens, these data will be valuable if due diligence results in a proposed reduction in the purchase price. Then you can point to these synergistic savings to get the deal across the goal line.

Also Read

Which Business Value Method Most Accurately Predicts Business Value?

10 Things I Wish I Knew Before Selling My Business

Selling Your Business: A Primer for Maximizing and Monetizing Your Life’s Work