If you own a marketing services agency or professional services firm, when the time is right to sell, you most likely will be presented with deal structures that include earn-out provisions. In turn, if you have a buy and build strategy and your growth plans include acquisitions, you most likely will include some form of provisions or contingency plans when you craft and present offers. Knowing your net worth and peace of mind will be impacted by the terms of the sales agreements, you and your advisory team should take the lead to structure and negotiate terms that are fair to all and protect you.

What are Earn-outs?

An earn-out agreement is an arrangement between a seller and buyer where a portion or all of the selling price is contingent on future performance. It’s a mechanism to shift some of the risk from the buyer to the seller while granting the seller upside opportunities. A portion of the selling price is deferred and calculated based on achieving certain performance metrics.

Why are they included in so many M&A deal structures?

If you own a services firm, what you are really selling is the future cash flow of the business. While your past performance provides credibility and gets you to the table, future cash flow is the foundation that most sophisticated buyers will base their valuations upon. Having safeguards for the buyer to help assure your company delivers that cash flow should enable you to command more dollars for the company. Buyers need assurances that clients and employees will stay, the company is not overly dependent on the selling owners, and there is clear evidence of sustained growth.

Most sellers perceive their companies are worth more than they are. These provisions can bridge the valuation gap between an optimistic seller and skeptical buyer. It enables the business to prove its worth.

How do earn-outs work? They are financing instruments that use the future cash flow of the business to supplement cash and debt from the buyer to fund transactions. They help assure a smooth transition because the sellers have incentives to stay involved post-sale and mitigate risk for the buyers and provide incentives for the sellers to help get deals done.

Elements of Earn-outs

Based on our experience crafting exit plans and facilitating M&A transactions for nearly 200 agencies (sell-side and buy-side representation), here are 12 elements of what we believe are best practices when designing and negotiating terms and provisions.

1. Performance Metrics

When designing and negotiating the performance metrics to track for earn-outs, the metrics should be selected so both the seller and buyer win when the benchmarks are achieved. In most situations, sellers prefer the scorecard be based on top-line performance such as Adjusted Gross Income (Total Revenue minus media and outside services purchased), while buyers prefer to track and reward for achieving bottom-line results such as Net Income or EBITDA. In some situations, the rewards for the deferred payments may be based on retaining specific clients, continued employment, or other non-financial metrics.

Try to keep the performance metrics to one or two benchmarks and avoid situations where it’s all or nothing for crossing thresholds. This can be accomplished by having linear or scaled earnings metrics.

2. Interim Payments

Sellers, of course, do not want to wait until the end of a period to get all their money, so most earn-out agreements include cash at closing plus interim payments made annually or quarterly. The interim payments may have strings attached to help safeguard the buyer. At the end of that period when the total purchase price is determined, the final or “true-up” payment is equal to the calculated purchase price minus the cash at closing and minus the interim payments.

3. Operating Control

If you are the seller, some of the most important provisions to negotiate center around operating control of the business during the earn-out period. If the purchase price is based on hitting Net Income or EBITDA benchmarks, then you must control the variables that impact the P&L statement. Define the seller’s rights in the Purchase Agreement or Operating/Shareholders’ Agreement. Get the buyer’s commitment to leave operations largely unchanged during the earn-out period in writing. If the buyer insists on investments or expenses that are outside historic levels, then try to negotiate that those select expenses are add-backs to the Net Income or EBITDA calculation.

4. Cross-Selling

If you sell to an industry strategic buyer, one important reason for the transaction may be the cross-selling opportunities for both companies. If you are the seller, you are going to want to penetrate the resources of the overall enterprise and seek cross-selling opportunities with the buyer’s clients. The buyer will want to leverage the seller’s staff, intellectual capital, and clients. To help capitalize on opportunities, you should define in writing the consequences of cross-selling situations. For example, you can establish internal rates that may be 10% to 20% lower than normal client rates when work is sent between companies. This structure will reward the seller for cross-selling the buyer’s clients while keeping a portion of the profits with the buyer when the full rates are billed to the clients. In turn, if the buyer sends work to the seller, the seller does not have to worry that their resources are being taken away from work that impacts the Net Income or EBITDA calculation because they are being rewarded with the internal rates when the scorecard is calculated.

5. Growth Plan

Sophisticated buyers may pay respectable to high multiples if they believe the acquired company will grow and help hit their financial targets. The buyer and seller together should develop a growth plan and define the investments needed to accomplish the goals. Once defined, both sides should agree (and put in writing) how the investments will impact the earn-out calculation. You want to avoid situations where the seller may be motivated to make short-term decisions to maximize the earn-out that may not be in the best long-term interests of the overall enterprise. For example, we negotiated a provision for a sell-side client that had the buyer making investments to help grow the company and those investments were add-backs to the EBITDA calculation.

6. Ceiling and Floors

Sellers would love to have an uncapped earn-out formula, but most experienced buyers will build-in a safeguard with a ceiling on the purchase price. We try to negotiate a floor and ceiling that is equitable to both sides. For example, if the target purchase price is 5.00 X EBITDA, the guaranteed dollars may be 3.50 X and the purchase price might go as high as 6.50 X based on performance.

7. Time Period

The most common time period for an earn-out formula is three years, with the range between one and five years. Buyers typically prefer longer periods to reduce risk and spread out the payments. The tracking period can be a combination of historic and future periods. For example, we recently structured a transaction where the formula was a four-year EBITDA average with the period being the trailing 12 months and the future 36 months.

8. Incentives for Key Employees

If the seller’s upside pay day is contingent on future performance, the seller should consider instituting incentives for key employees that track with the performance metrics of the earn-out plan. This can be accomplished via Phantom Stock Plans or Stay Bonus Plans. With the Phantom Plan, select employees can earn a percentage of the purchase price as it gets paid to the seller providing they remain employed. With a Stay Bonus, employees can earn a bonus if they remain with the company for a specific period of time. Buyers welcome situations where employees have incentives to stay.

9. Taxation

If you are a seller, you want as much, if not all, of the payments to be taxed as capital gains; whereas, buyers would value some of the payments paid as ordinary income, so they can realize immediate deductions. When structured properly, the IRS under general tax principles (Arrowsmith v. Commissioner, 344 U.S. 6) allows deferred payments to be eligible for installment sale treatment and taxed as capital gains for the seller. When earn-out payments are part of a deal, it is critical to identify as early as possible if the deferred payments will represent (i) deferred payments eligible for installment sale treatment, (ii) payments as compensation for continued employment, and/or (iii) payments for a non-compete covenant.

10. Change of Control

To protect sellers, the agreement should include a clause that if the buyer sells during the earn-out period, the deferred payments would immediately vest upon a change of control. In turn, buyers would try to exclude this clause to avoid the accelerated payments.

11. Accounting and Conflict Resolutions

The earn-out provisions that are typically embedded in the Asset Purchase or Stock Purchase Agreement should clearly define the accounting method to track performance and how to resolve resolutions. Most agreements specify GAAP accounting methods. If disputes arise, the agreement can stipulate that an appointed third-party CPA or consulting firm is to be the arbitrator.

12. Clarity

In summary, whether you are a buyer or seller, you want as much clarity as possible with the terms and conditions of earn-out provisions. No ambiguity. Take time to define, negotiate, and put in writing the key performance metrices, operating guidelines, growth plans, governance guidelines, and more so your M&A transaction goes as planned and is a win-win for the seller and buyer.

Sample Formulas

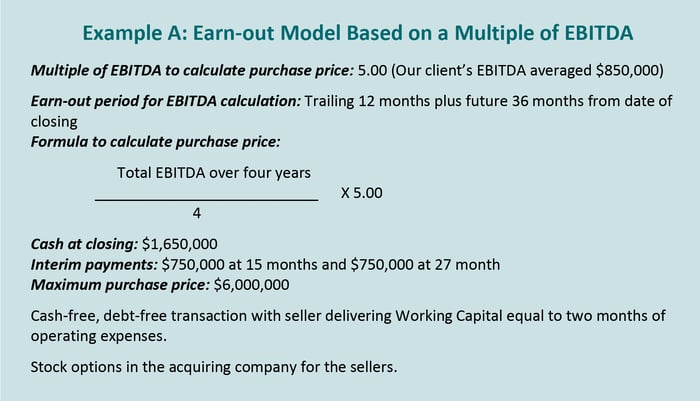

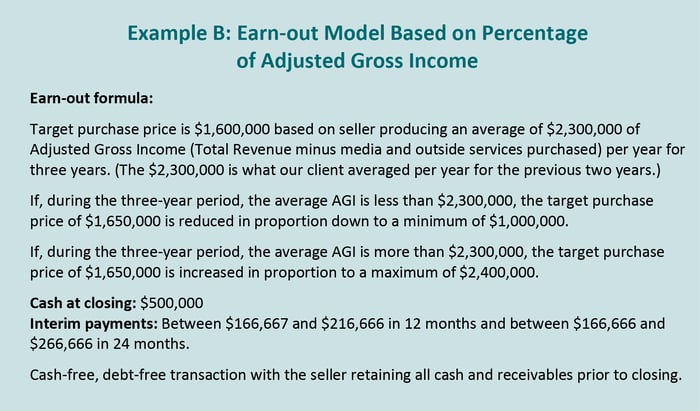

Here are two earn-out formulas TobinLeff recently designed and negotiated for sell-side clients. The first formula, based on a multiple of EBITDA, was instituted because our client is going to maintain a separate profit center during the earn-out period and the buyer insisted on a formula driven by profits. The second formula, based on a percentage of Adjusted Gross Income, was established because our client company was immediately integrated into the buyer’s enterprise and our client was going to have limited control over the expenses. For both transactions, we incorporated most of the terms and recommendations outlined in this white paper to help protect our clients.

Click here for your complimentary copy: TL 12 Elements of Earn-outs White Paper